Quick Take

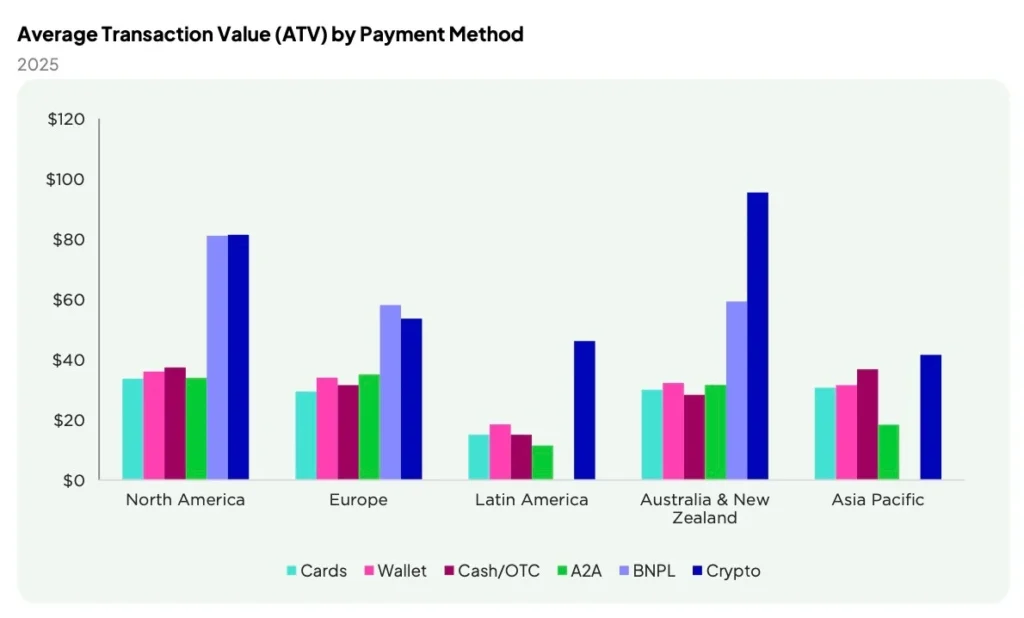

- Newzoo-Tebex data shows crypto and BNPL payments have higher average transaction values in North America, Europe, Australia, and New Zealand.

- Despite higher spend per purchase, these payment methods remain a small share of total gaming transactions.

- Shooters, RPGs, and puzzle games lead revenue in the US, while sports titles dominate in Europe.

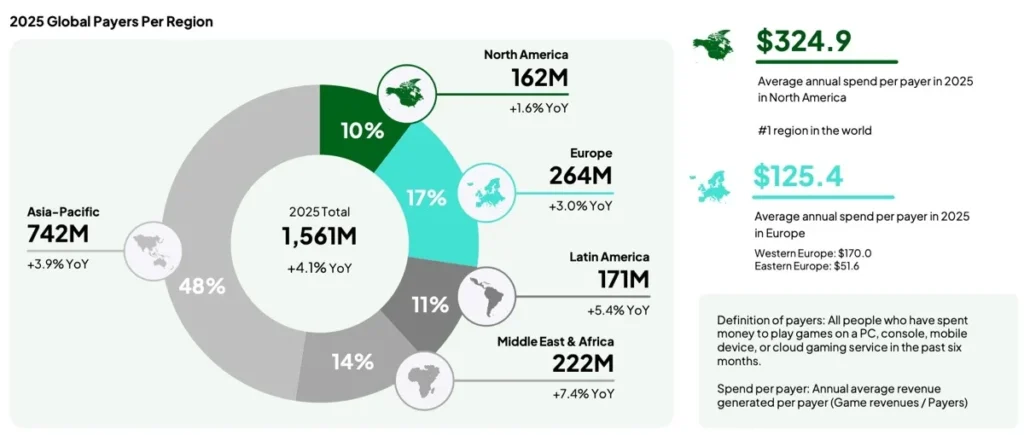

The global gaming market is projected to reach $188.9 billion in 2025, with North America and Europe accounting for 46% of total spending despite representing just 20% of the world’s player base. A new report from Newzoo in collaboration with Tebex provides a detailed breakdown of how players are paying for games and which regions are seeing the fastest growth.

Regional Spending and Growth Patterns

Asia-Pacific dominates in total number of paying players with 742 million (+3.9% YoY), followed by the Middle East & Africa (222M, +7.4%), Europe (264M, +3%), Latin America (171M, +5.4%), and North America (162M, +1.6%).

While North America has the highest annual revenue per paying user (ARPPU) at $324.9, Europe is growing faster with a projected 3.1% annual growth rate in paying players between 2023 and 2027 compared to North America’s 1.1%.

Payment Preferences: Cards, BNPL, and Crypto

In Western markets, buy now, pay later (BNPL) and cryptocurrency payments both have a higher average transaction value (ATV) than traditional card payments. North America, Europe, Australia, and New Zealand all recorded above-average ATVs for these methods.

However, Tebex notes that the volume of crypto transactions remains relatively small compared to cards, even if the median purchase size is larger. The pattern suggests that players using BNPL or crypto tend to make fewer but higher-value purchases.

Interestingly, among players who have used both cards and BNPL, there was no drop in purchase frequency indicating that these alternative methods are not replacing transactions but potentially enabling more expensive or premium purchases.

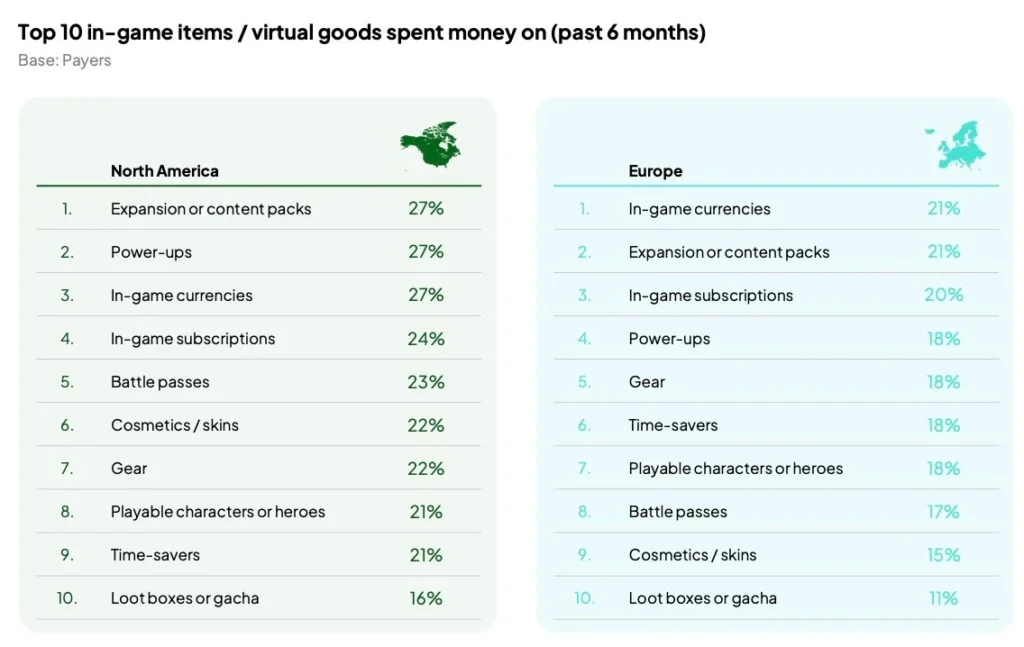

What Players Are Buying and Why

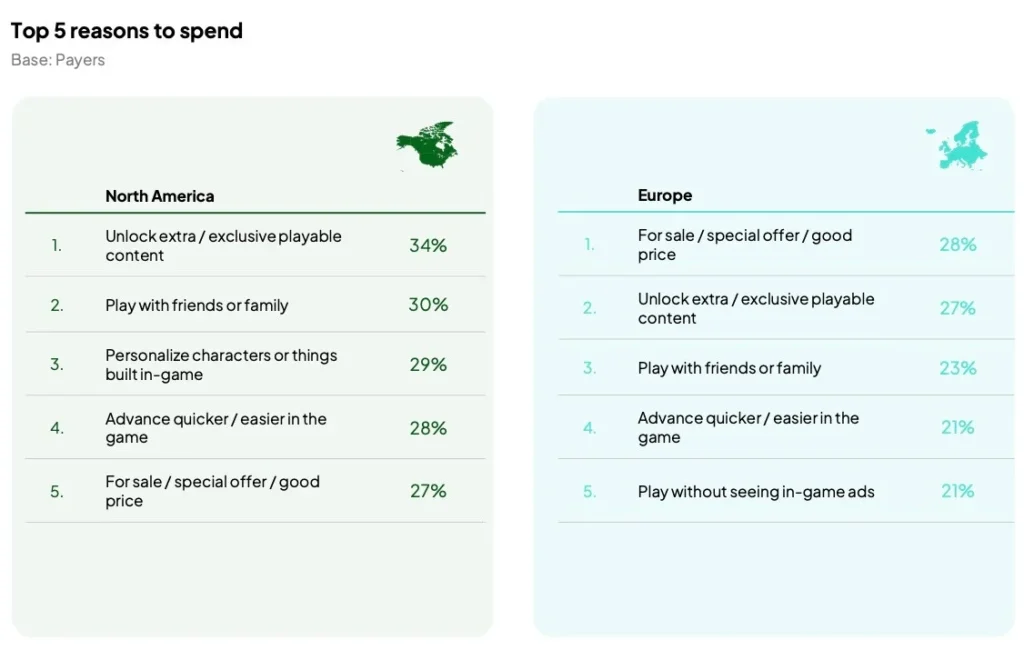

In North America, the top motivations for spending are unlocking new content (34%), playing with friends or family (30%), and personalization or building in-game items (29%). In Europe, discounts and special offers are a bigger driver (28%), with a notable share (21%) paying to remove ads.

The study found that most players do not limit themselves to one type of purchase. Instead, they often spend across microtransactions, downloadable content (DLC), and subscriptions.

Genre and Platform Differences

Shooters, RPGs, and puzzle games generate the highest earnings in the U.S., with console subscriptions accounting for 21% of all console spending which is a unique revenue mix not seen as strongly in PC or mobile. Despite the subscription model, more premium titles are still bought outright on console (52%) than on PC (49%).

In Europe, sports games lead earnings, and microtransactions are a consistent revenue driver across both PC and console.

Crypto Payments in the Bigger Picture

While crypto payments are still a niche option in gaming, the higher ATVs suggest a potential for growth, particularly in crypto gaming ecosystems where digital asset ownership is already a core feature. For developers targeting Web3 audiences, these insights reinforce the importance of offering flexible payment options alongside traditional methods.

Takeaways for Developers and Publishers

The data points to three key trends:

- Europe is catching up in spending growth despite North America’s higher per-player revenue.

- Alternative payments like BNPL and crypto attract bigger individual transactions, even if overall usage remains low.

- Microtransactions and subscriptions remain central to revenue, but player motivations vary by region, offering room for targeted monetization strategies.

As the industry moves toward more diverse payment ecosystems, these findings suggest that while crypto may not yet rival cards for transaction volume, it holds strategic value in markets and genres where higher-value purchases are common.