Quick Takes

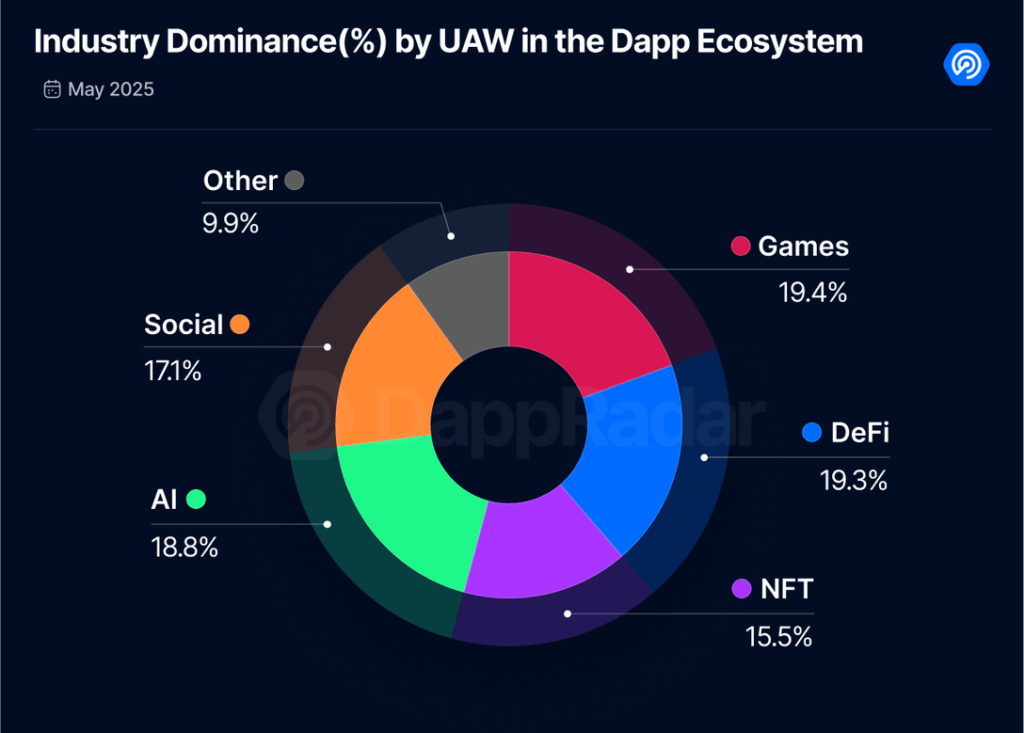

- Daily dapp usage hit 25M wallets in May, the highest since the last bull market peak

- DeFi TVL surged 25% to $200B with Hyperliquid recording $244B in monthly volume

- AI dapps reached 4.8M users, nearly matching gaming and DeFi activity levels

The decentralized app (Dapp) space posted one of its strongest months since the last cycle peak, according to DappRadar’s May 2025 industry report. With total DeFi value locked jumping to $200 billion, NFT volumes spiking 40%, and AI dapps now matching DeFi in daily usage, this was less about hype and more about infrastructure finally catching up to ambition.

User activity broke through the 25 million daily wallet mark, an 8% increase month-over-month and the highest number recorded since the bull market. That growth spread across sectors, not just among early movers. AI, Social, and NFT dapps all logged solid gains, with AI alone up 23% month-over-month. Combined with DeFi’s resurgence, this convergence signals a healthier, more balanced Web3 stack forming in real time.

DeFi Strength Returns as Infrastructure Matures

DeFi climbed back toward its previous high-water marks in May, helped by Ethereum’s 40% price bump and increased institutional participation. The sector added $40 billion in total value locked (TVL), pushing the metric to $200 billion for the first time in over a year.

A significant driver was Hyperliquid, a decentralized exchange that clocked $244 billion in trading volume last month alone. That performance gave it nearly 10% of Binance’s volume, placing it in the top five exchanges globally across both centralized and decentralized platforms.

Ethereum’s Pectra upgrade also played a key role. New features like account abstraction and an increased validator cap from 32 to 2048 ETH introduced better UX and capital efficiency. Combined with policy movement such as the U.S. Senate’s GENIUS Act advancing and Ripple launching a MiCA-compliant euro stablecoin—DeFi now looks more capable of scaling up in a regulatory-friendly environment.

AI Dapps: From Narrative to Daily Utility

Artificial intelligence has officially moved beyond the narrative phase. AI dapps attracted 4.8 million daily wallets in May, up 23% and rivaling both gaming and DeFi in raw engagement. SubHub, an AI-powered Web3 communication tool, was one of the standout performers. Built by Dmail, it brings wallet-based targeting and AI-enhanced delivery to the decentralized messaging layer, marking a shift toward intelligent, user-centric outreach in Web3.

The report also noted developments in infrastructure and investment:

- Tether announced plans to launch a decentralized AI platform

- Donut Labs raised $7M to build an AI-native Web3 browser

- ThinkAgents released a protocol standard for open AI agents

- Assisterr raised $2.8M to support no-code deployment of lightweight models

According to a Harris Poll cited in the report, 77% of Americans said they prefer decentralized AI models, a figure that supports the case for AI-native protocols in Web3.

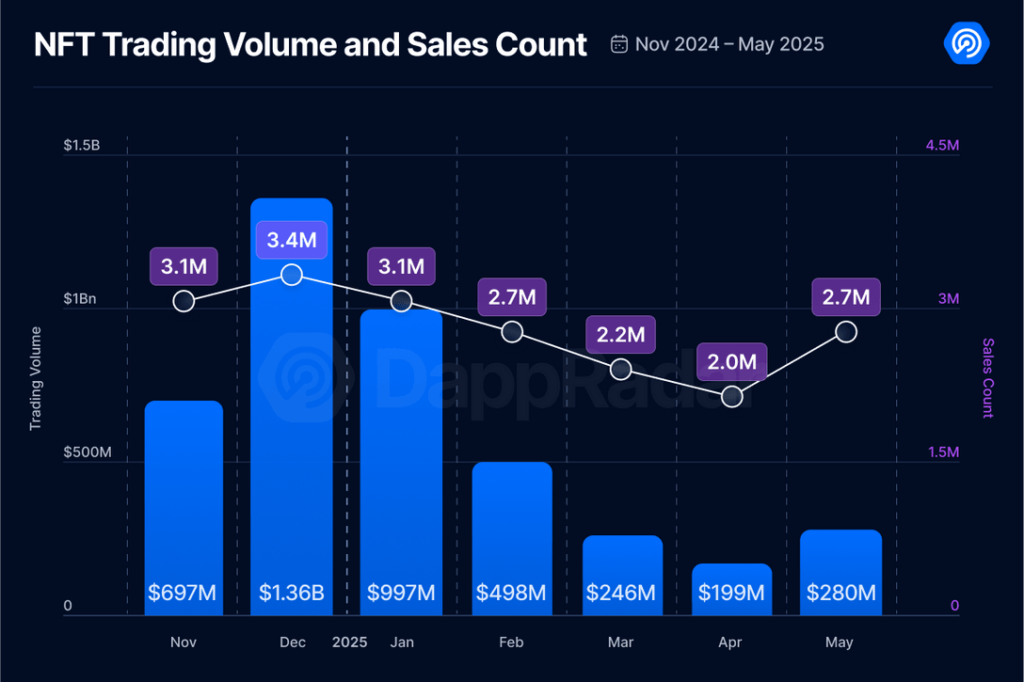

NFTs Rally on Chain Activity, Not Just Speculation

NFTs showed surprising resilience, with trading volume climbing 40% to $280 million in May. Ethereum reclaimed 53% market share, followed by Immutable zkEVM and Abstract. The latter saw a 1200% surge in volume, largely driven by airdrop incentives and farming activity.

The strongest growth came from art-based and domain NFTs, including projects linked to Telegram. Apple’s decision to drop its 30% in-app purchase fee on NFTs was also flagged as a catalyst for future mobile adoption.

OpenSea’s OS 2.0 launch added support for 19 blockchains and fungible tokens, while FIFA’s NFT platform migration to an EVM-compatible chain further positioned NFTs for cross-platform integration.

Real-world assets (RWAs) are also entering the frame. Courtyard surpassed $55 million in trading volume, signaling demand for asset-backed NFTs beyond profile pictures and collectibles.

Security Remains a Roadblock

Despite growth across verticals, the month wasn’t without major setbacks. More than $275 million was lost to exploits, the third-worst month in a year. The largest incident came from Cetus Protocol on Sui, where an attack drained $260 million. Cork Protocol and Mobius Token suffered additional losses totaling over $14 million combined.

The report pointed out that while these were fewer in number than April’s 20+ incidents, the sheer scale of losses underscores a serious threat to long-term adoption. Audit standards, developer education, and real-time threat detection are still falling behind.

A Market in Transition

Across nearly every section of the DappRadar report, one message came through clearly: Web3 is slowly transitioning from a market defined by speculation to one guided by infrastructure, interoperability, and user utility.

DeFi’s return to form, AI’s explosion in daily users, and NFTs regaining ground outside of just meme-driven hype point to a more mature cycle taking shape. That said, security remains an existential issue and one that could stall momentum just as it begins to accelerate.

Until that’s resolved, the gains of May remain promising but precarious.

Image sources: All visuals via DappRadar