Quick Take

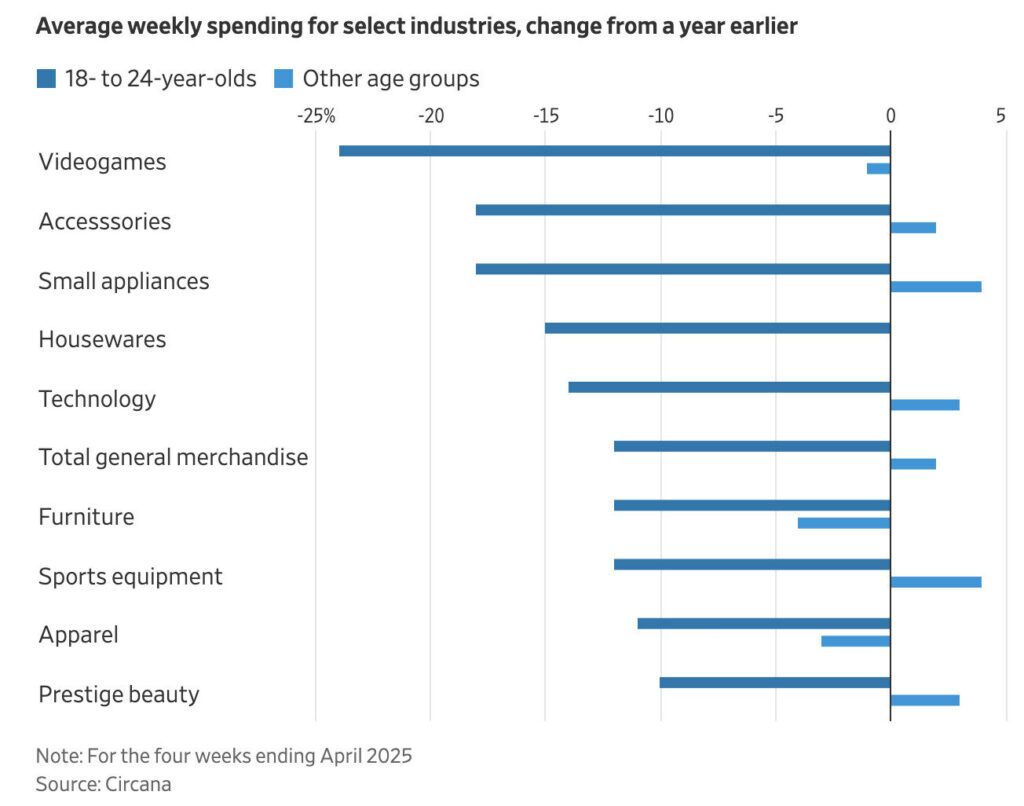

- 18–24 year olds cut game spending nearly 25% year-over-year

- Credit stress, loan repayments, and rising prices driving economic pullback

- Circana lowers 2025 forecast for US gaming revenue to $56.5 billion

Game spending among young Americans has dropped fast in 2025.

New data from Circana shows that players aged 18 to 24 have cut their video game purchases by nearly 25% year-over-year—more than any other age group. That’s a sharper contraction than what was seen in tech, apparel, or accessories, all of which also declined.

Spending across all categories was down 13% for this age group from January through April, but video games saw the steepest drop.

The data was shared via The Wall Street Journal, citing economic stress as the main driver. Student loan payments restarted last fall, and credit card delinquency rates are at their highest level since before the pandemic—especially for borrowers under 30. At the same time, publishers have raised game prices to $70 or $80, while in-game monetization continues to expand.

“Young grads are having a much tougher time finding jobs,” the WSJ report notes. “Credit-card delinquency rates have risen to their highest points since before the pandemic.”

Circana’s Mat Piscatella pointed out that players are still engaging with games—just differently. Free-to-play titles and subscription services are gaining traction again, as more players seek value without upfront costs. That shift may explain recent subscriber growth across services like Game Pass and PlayStation Plus, which had plateaued in previous years.

Still, the data has already reshaped forecasts. Circana has revised its 2025 gaming revenue estimate for the US down to $56.5 billion, a 4.7% drop from 2024 and the lowest since 2019. That previous forecast had included a 4.3% expected growth, largely based on the assumption that Grand Theft Auto 6 would launch late in the year.

“The consumer is holding back a little,” Piscatella said. “They need to believe they’re getting good value for their gaming dollar.”

The slump also arrives amid historic layoffs. More than 2,800 developers have lost their jobs in 2025 so far, following 14,600 cuts last year. Microsoft’s latest round alone could push that number well past 10,000.

June’s Nintendo Switch 2 launch may lift Q2 spending, and GTA 6 is still expected to set industry-wide records when it drops. But in the meantime, many younger players are choosing to skip new releases altogether.

Rent is going up everything is getting more expensive and we are not making more money