Quick Take

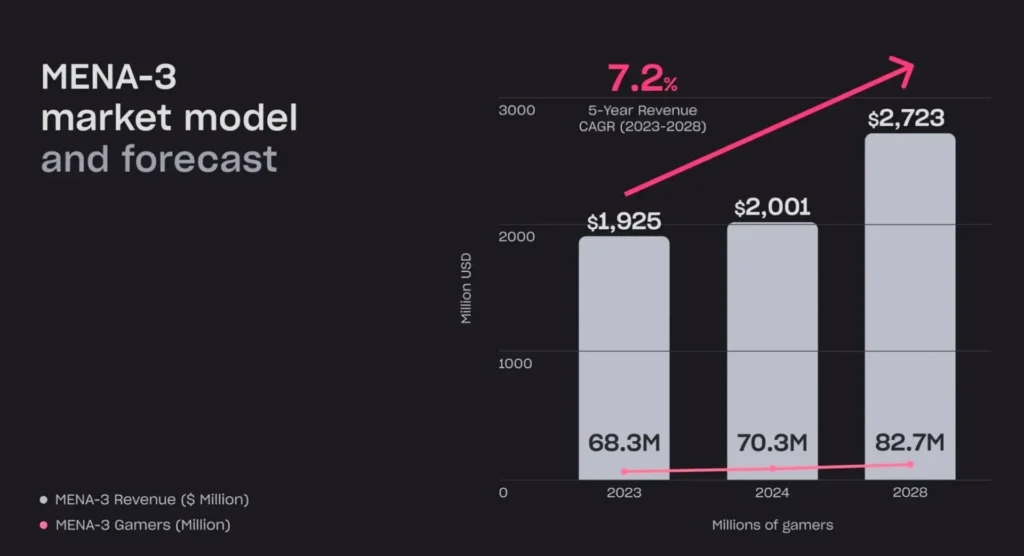

- The MENA-3 gaming market is set to grow 7.2% annually, reaching $2.7 billion by 2028

- Mobile is the dominant platform, played by 94% of the region’s gaming population

- UAE leads in average spend, while Egypt lags due to low financial access

A joint report from Xsolla and Niko Partners outlines the current state and trajectory of the gaming market in the Middle East and North Africa, focusing specifically on Saudi Arabia, the United Arab Emirates, and Egypt. The findings project steady regional growth, with the total market value expected to increase from $2 billion in 2024 to $2.7 billion by 2028, driven by a compound annual growth rate of 7.2%.

Market Roles and Country Differences

Each country in the MENA-3 group plays a distinct role. Saudi Arabia continues to lead in total revenue and monetization, having crossed the $1 billion mark in 2022. That figure is forecast to hit $1.5 billion by 2027. The UAE, while smaller in population, shows the strongest payment metrics and the highest annual revenue per user at $84.60. Egypt has the largest player base potential but limited monetization, in part due to low financial inclusion and credit access.

Across the three countries, the player base is growing quickly. There were 70.3 million players in 2024, and that number is expected to reach 82.7 million by 2028. Only about half of the total population in these countries currently plays games, pointing to substantial room for expansion.

Platforms, Demographics, and Access

Mobile dominates the platform landscape, with 94% of players engaging through smartphones or tablets. PC and console gaming are also prominent, with 49% and 34% of the surveyed population playing on those platforms, respectively. This makes the region significantly more multi-platform than many other emerging markets. Over 60% of MENA-3 players use two or more platforms regularly.

The demographics skew young. Over 60% of players are aged between 18 and 35, though the number is likely higher since those under 18 were not surveyed. Internet penetration is near-universal in Saudi Arabia and the UAE, and above 70% in Egypt. Female representation among gamers has also seen an upward trend, growing from 32% in 2022 to 38% in 2025.

Spending Power and Game Preference

Spending habits reflect economic differences between the countries. The average monthly salary of a gamer in MENA-3 is $2,166, though this rises to $3,137 when excluding Egypt. In Egypt, only 4% of surveyed players reported earning more than $900 a month, compared to 86% in Saudi Arabia and 96% in the UAE. As a result, premium games and subscriptions see better traction in the Gulf than in North Africa.

A significant share of players are willing to pay for games. Over 63% of respondents said they’ve spent money on games, and multi-device users were more likely to switch platforms regularly and engage with different monetization formats. Players reported an average of 10.2 hours of gaming per week, with 31% of Egyptian players clocking over 13.25 hours.

Monetization models show a strong preference for free-to-play formats. Among mobile gamers, 61% favor F2P with in-app purchases. On PC, that figure is 56%. Saudi Arabia leads in the adoption of premium games, with 26% of players indicating a preference for full-priced titles.

Payment Barriers and Workarounds

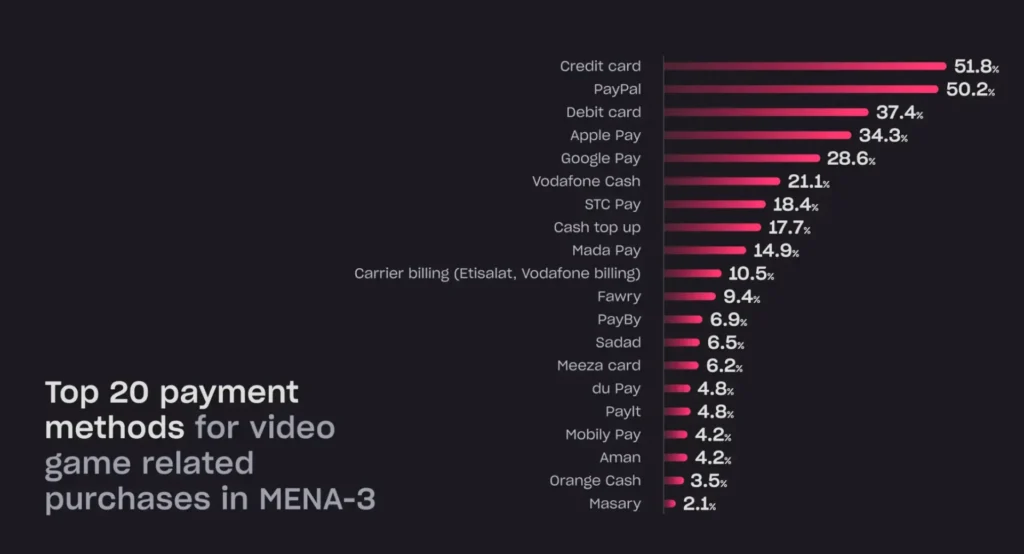

Banking infrastructure continues to impact purchasing behavior. The majority of the region remains underbanked, with credit card penetration at just 2.8% in Egypt and around 25% in Saudi Arabia and the UAE. Alternative payment options dominate. In Saudi Arabia, Mada is used by 93% of respondents, while PayPal ranks above credit cards in usage. UAE players enjoy a financial infrastructure more similar to Western markets.

Purchasing outside of standard app stores is common. More than half of surveyed players have made direct purchases from game websites. Motivations include better pricing, familiar payment options, and exclusive bonuses. In Egypt, over 60% of players engage in this type of purchasing behavior.

Price Sensitivity and Monetization Outlook

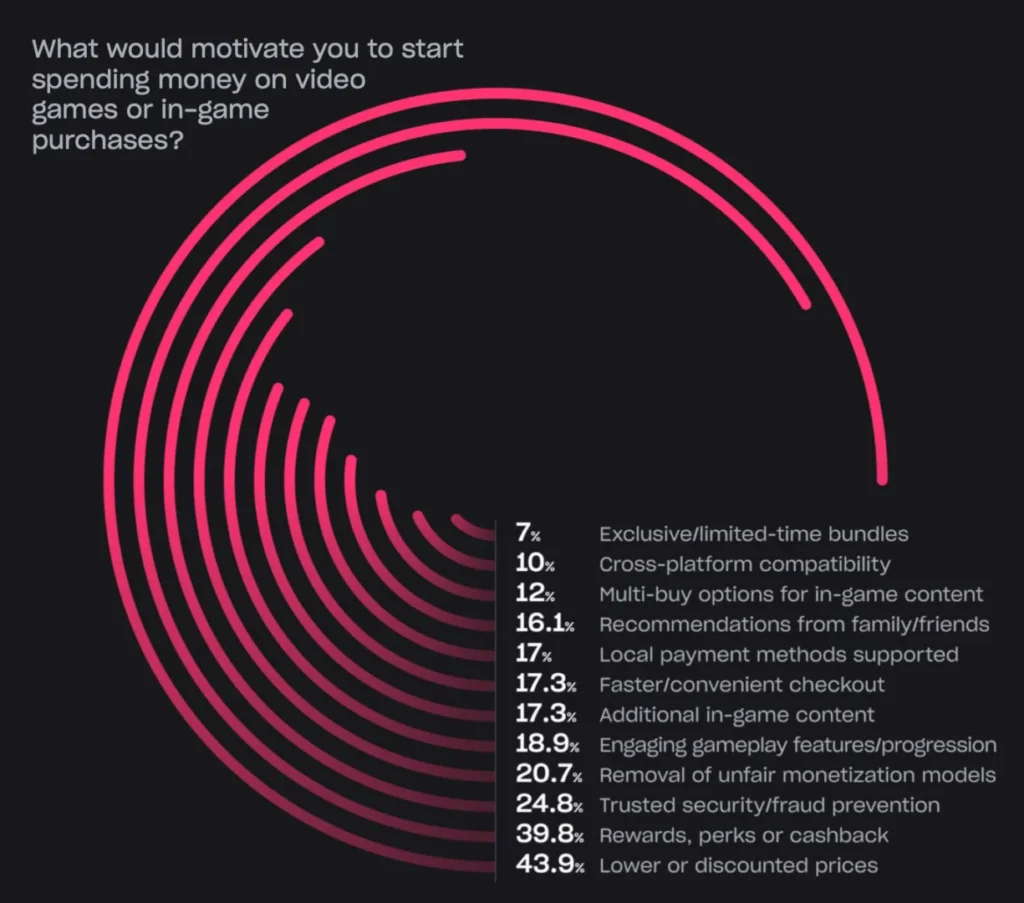

Price sensitivity plays a key role in shaping spending habits. Nearly 44% of respondents across the region cited lower prices as the main incentive that would encourage them to spend more. However, the impact of discounts and reward-based incentives on long-term revenue growth remains unclear.

The full study was published by Xsolla in collaboration with Niko Partners and can be accessed through GameDev Reports.

Source: GAM3S.GG (Eliza Crichton-Stuart)

Data from: Xsolla & Niko Partners 2025 MENA-3 Market Research Report