Polygon’s co-founder and longtime figurehead Sandeep Nailwal has officially taken the reins as CEO of the Polygon Foundation, stepping into the role for the first time since the organization’s inception. In a statement posted on X, Nailwal said he’s assuming control to “provide clear direction and focused execution” at a time when the network is undergoing major technical and strategic realignment.

Marc Boiron will remain CEO of Polygon Labs, the company behind core protocol development, while Nailwal will oversee the broader foundation structure that includes key contributors and affiliated entities.

Nailwal cited the need for sharper execution during what he called a “zero to one” phase for the broader Ethereum ecosystem. He pointed to Polygon’s strong treasury, which reportedly holds hundreds of millions in cash, as a key reason the foundation can now refocus without distraction or fundraising pressure.

Strategic Reset: zkEVM Sunset and Focus on Agglayer

The new CEO didn’t wait to make changes. Among the first moves is the planned deprecation of zkEVM in 2026, a notable shift given the resources previously allocated to zero-knowledge rollup development. Instead, the foundation will focus entirely on scaling two products: Polygon PoS and Agglayer, the network’s unified liquidity and interoperability layer.

Polygon PoS is being positioned as the primary chain for stablecoin-based payments and real-world asset (RWA) transactions. Agglayer, which launched in late 2024, will operate as a settlement layer for other chains, emphasizing fast cross-chain asset movement and shared security. The next major version of Agglayer (v0.3) is scheduled for rollout during the week of June 30.

New spinouts will also continue under the Agglayer Breakout program, which rewards POL stakers with airdrops tied to protocol launches. The ZK research effort will shift to Polygon ZisK, now led by Jordi Baylina, as the foundation reorganizes its advanced cryptography initiatives into standalone units.

Scaling Up: The Gigagas Roadmap

Underpinning these changes is a sweeping technical plan called the Gigagas roadmap, which aims to scale Polygon PoS from current testnet levels of 1,000 transactions per second (TPS) to more than 100,000 TPS in the coming years. In the near term, testnet upgrades already in place will push mainnet performance past 5,000 TPS by fall 2025, with finality times dropping below one second and chain reorganizations eliminated entirely.

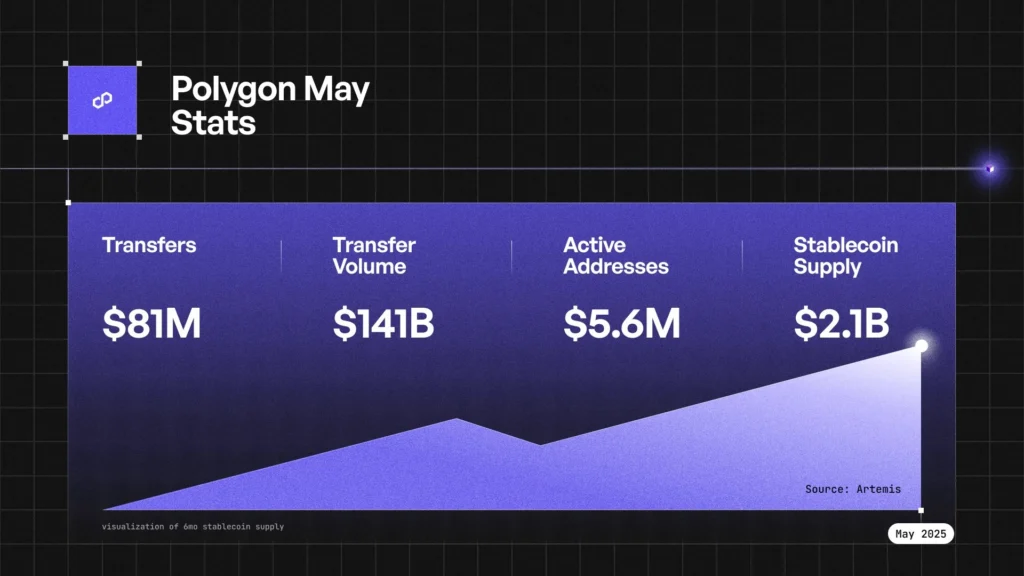

Polygon Labs describes the strategy as building “the rails for digital payments,” with performance benchmarks designed to support high-frequency stablecoin use and institutional-grade financial products. The roadmap aligns closely with growing adoption: May metrics shared by Artemis showed 5.6 million active addresses on Polygon, $141 billion in transfer volume, and a $2.1 billion stablecoin supply.

The foundation plans to align Agglayer more directly with the Polygon brand and will conduct educational campaigns around the MATIC-to-POL token migration, which Nailwal says is now drawing renewed interest from market makers following the SEC’s decision to drop its inquiry into MATIC.

IPO Path and Broader Expansion

Polygon’s recent growth in real-world asset activity also supports that trajectory. According to the network, over $271 million in RWAs now move on Polygon, including tokenized Pokémon collectibles via Courtyard and regulated credit funds by Apollo and Securitize. The chain has also reported rising stablecoin usage by fintechs and institutions including Stripe, Jio, and BlackRock.

What Comes Next

With Nailwal at the helm, the foundation is shifting away from institutional-style governance and back to a founder-led model tailored to speed, execution, and product-market fit. “Institutional setups are great for stability, but they tend to produce average-case decisions,” he said. “Polygon is now back as a zero-to-one startup setup.”

The move consolidates vision and leadership during a time of technical complexity and market pressure, but also growing opportunity. Nailwal closed his announcement with a simple message: “Let’s play.”