Quick Take

- Web3 gaming funding hit $50M+ in June–July, topping April–May’s total combined

- Traditional game markets posted $9.5B in M&A deals and 20% Steam revenue growth

- User-generated platforms and console sales continue to climb

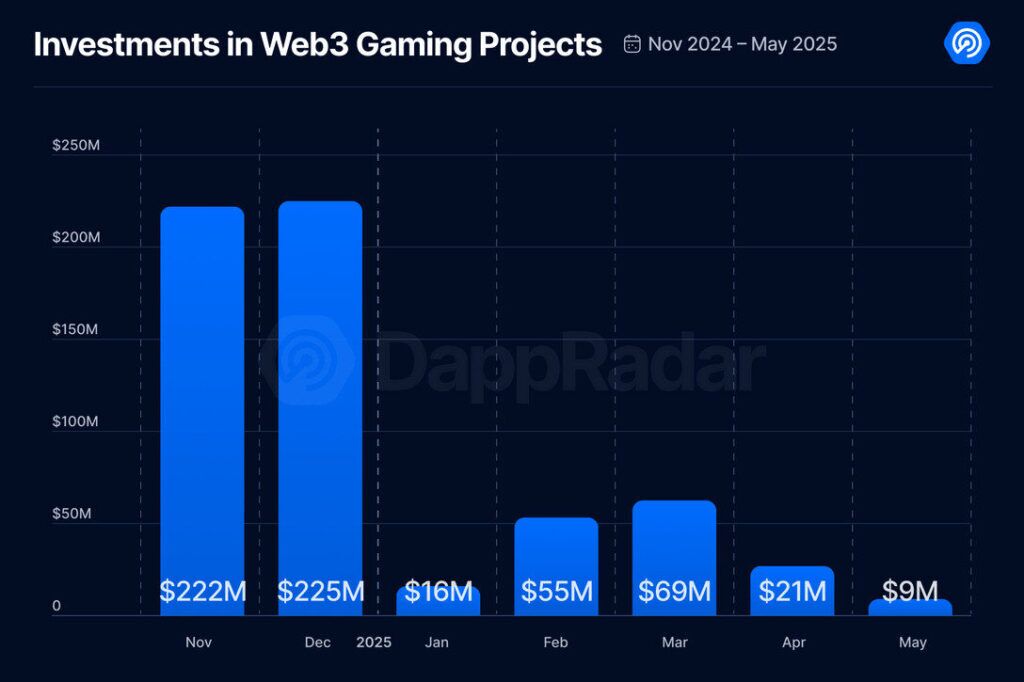

After hitting a low point in April and May, funding for Web3 gaming is showing signs of life again. New data collected through early July shows the sector raised over $50 million across multiple deals in the last 45 days, surpassing the combined total from the previous two months.

The turnaround is being led by projects like Reaper Actual, which raised $30.5 million in late June, and Wildcard, which secured $9 million. Other deals include Spekter Games ($5 million), Crystalfall ($2 million), and Uptopia ($4 million). The June–July wave follows a five-month stretch where crypto gaming investments had slowed to their lowest levels since 2020.

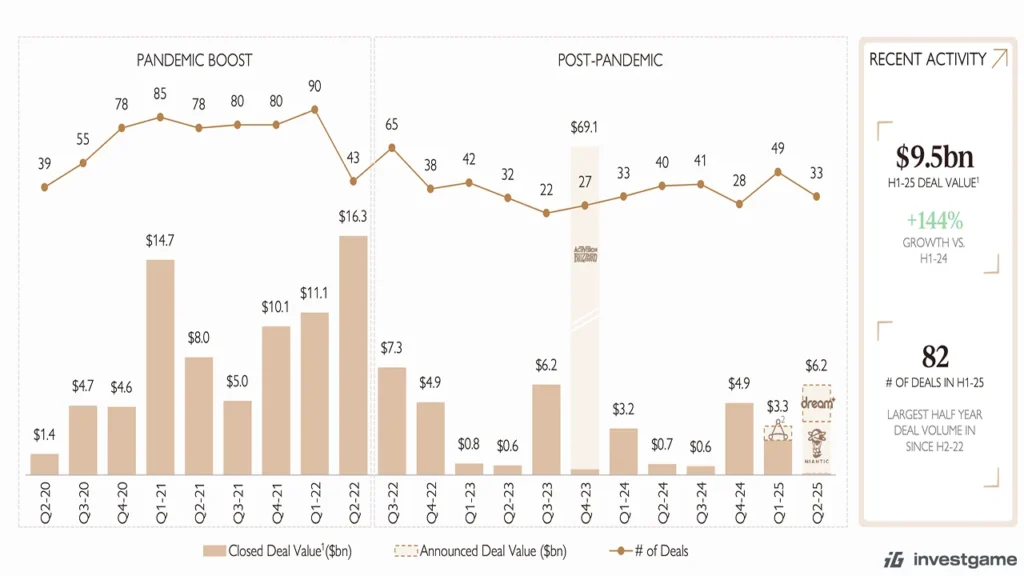

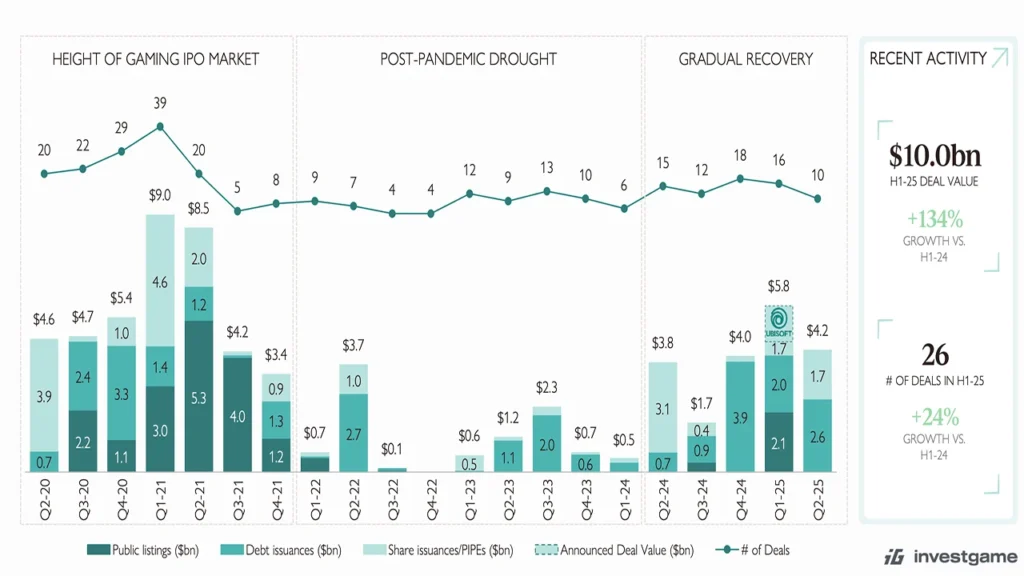

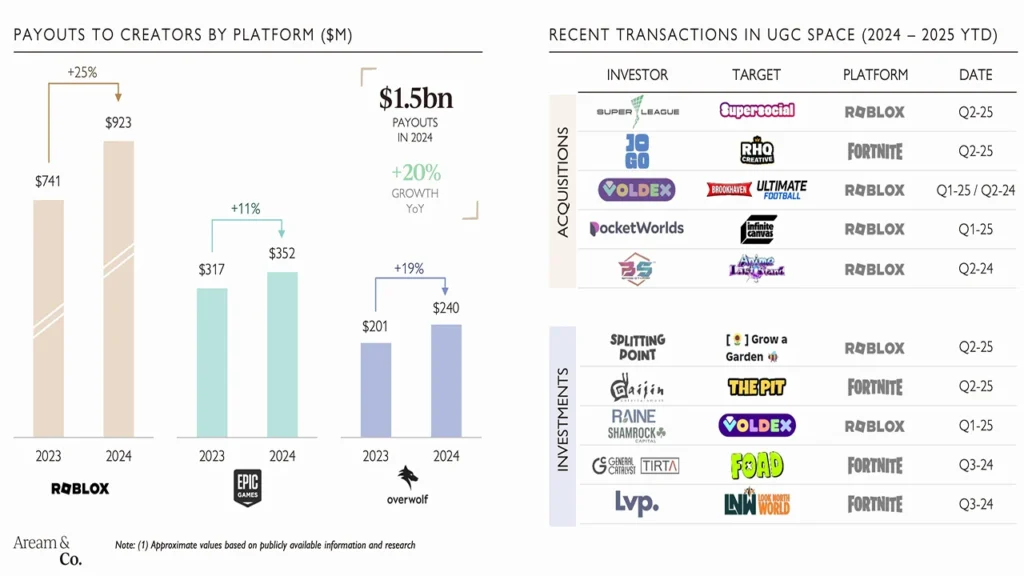

Meanwhile, the broader games industry is pacing ahead. Merger and Acquisitions (M&A) deals reached $9.5 billion in the first half of 2025, a post-pandemic high. Steam revenue rose 20% year-over-year, and UGC platforms like Roblox and Epic Games increased creator payouts across the board.

Blockchain Games Regain Momentum

Daily user activity in Web3 gaming remained strong through the dip. DappRadar’s latest data showed 4.9 million daily unique wallets engaging with game dapps in May. The sector still leads all other categories by user count, but market share fell to 19.4% from a January high of 27.8%.

While April and May brought just $30 million in total funding, the June–July rebound points to renewed investor interest. High-profile backers supported the latest rounds, and several projects are preparing game launches or live updates in Q3.

Top deals for June–July 2025 include:

- Reaper Actual – $30.5M

- PlayWildcard – $9M

- Spekter Games – $5M

- Uptopia – $4M

- Crystalfall – $2M

The rebound may not yet represent a full recovery, but it marks the most active funding period since end Q1.

Traditional Markets See Broad Gains

Outside of blockchain, the rest of the gaming market is performing well in 2025. Steam saw 20% revenue growth in Q2, with concurrent user figures at all-time highs. PC free-to-play games have grown 17% annually since 2020. Premium PC titles have grown 13% in the same span.

Console sales remain tied to hardware cycles, but the numbers are climbing. PlayStation 5 has now shipped 77 million units. Xbox reported 5% revenue growth for FY2024. Nintendo’s 30% revenue drop reflects timing around the Switch 2, not overall decline.

On the M&A side, deal count and volume both hit multi-year highs. The $9.5 billion recorded in H1 2025 came across 82 deals, the most since late 2022. Nearly all large acquisitions were in mobile, with the exception of the $2.2 billion Keywords Studios deal.

Public market activity also jumped. Gaming stocks are trading near 52-week highs, with PC/console developers seeing a 38% YoY increase and major diversified firms up 58%. Mobile studio stocks remain mixed, particularly in the West, where valuations have slid.

UGC Ecosystems and Platform Growth

User-generated content platforms remain one of the strongest segments. Roblox paid $923 million to creators in 2024, a 25% increase year-over-year. Epic and Overwolf also expanded payouts, with combined creator earnings reaching $1.5 billion.

VC capital continues to flow toward platforms building creator tools or lightweight onboarding. Studios like Sett, eloelo, and spAItial raised a combined $41 million in Q2 2025. These projects span AI, mobile-first tools, and social-based game infrastructure.

Web3 games, while still early in UGC maturity, are starting to integrate similar systems. A few newer projects have begun rolling out in-game modding tools or community asset programs. The long-term viability of these features will depend on active player bases and monetization loops that persist beyond TGE cycles.

Still a Recovery, Not a Rally

Even with the recent uptick, the overall funding environment for Web3 gaming remains tight. Many investors remain cautious following the wave of project shutdowns earlier this year. Titles like Ember Sword, The Mystery Society, and Nyan Heroes folded after raising millions, citing a lack of playable content and waning community interest.

The key challenge remains sustainable engagement. While player metrics are holding, and funding is climbing back, the sector still faces pressure to produce games that survive past their launch windows. Token speculation is no longer enough.

What Comes Next

For now, the summer 2025 recovery offers a window of momentum. Multiple blockchain games are planning key launches in Q3. Some have backing, others will need to prove value live. With traditional gaming riding a wave of investment and performance, the pressure is on Web3 teams to deliver games that hold players and keep investors interested.